Working people think like pensioners

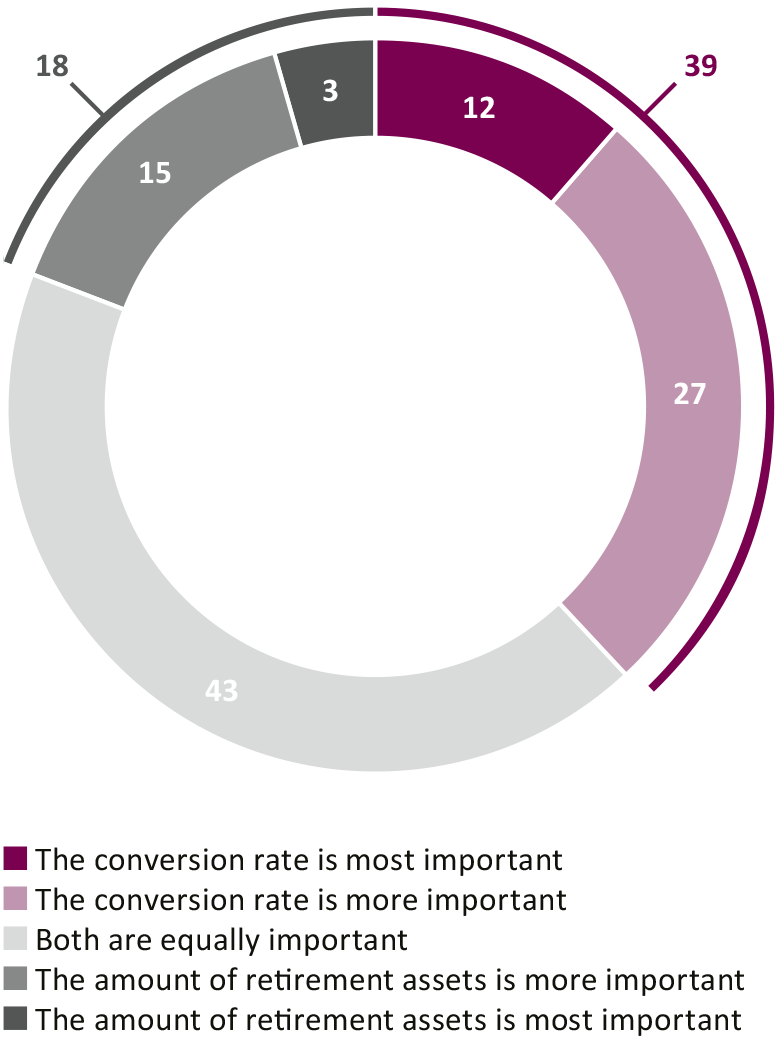

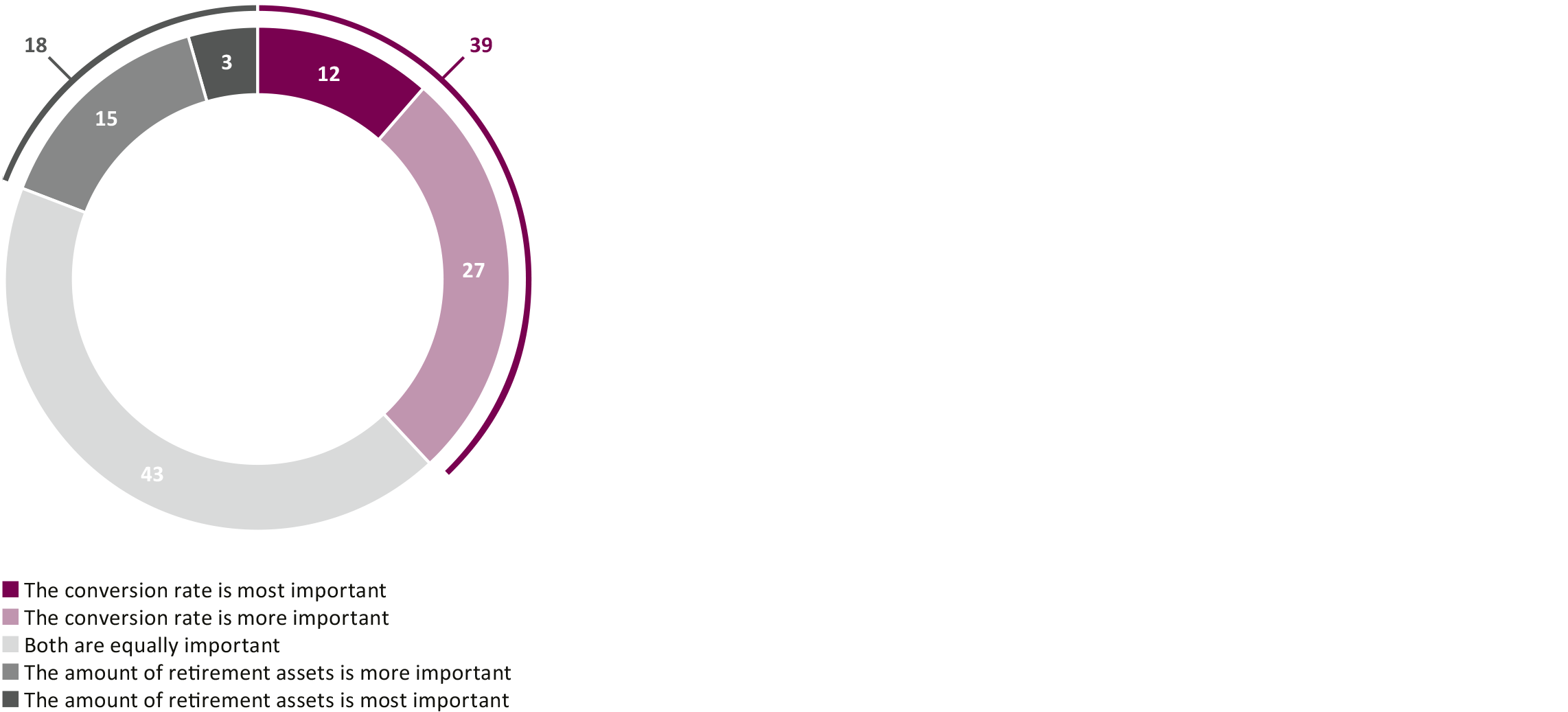

Although occupational retirement provision is a vital part of a person's income after retirement, as ever, many people in Switzerland give little thought to their savings in the 2nd pillar. The latest edition of the "Fairplay" study clearly shows how much the statutory conversion rate has become a symbol for the total pension amount within the 2nd pillar: 2 out of 5 (39 percent) of working respondents thought that the conversion rate was the most decisive factor in determining their pension amount after retirement. Only 1 out of 5 surveyed thought that their retirement savings were the most important factor. For the rest, both factors were equally relevant. "For many of those surveyed, the annual pension distribution rate was more important than building up pension capital: instead of increasing the size of the cake, they were more concerned with increasing the size of the slices that are distributed each year," summarizes Michael Hermann, Managing Director at the Sotomo research institute. However, whether the cake is cookie or pie-sized hardly matters in the discussion. Even younger survey respondents thought more like pensioners here than savers.

Estimation of the importance of the conversion rate and retirement assets for the pension

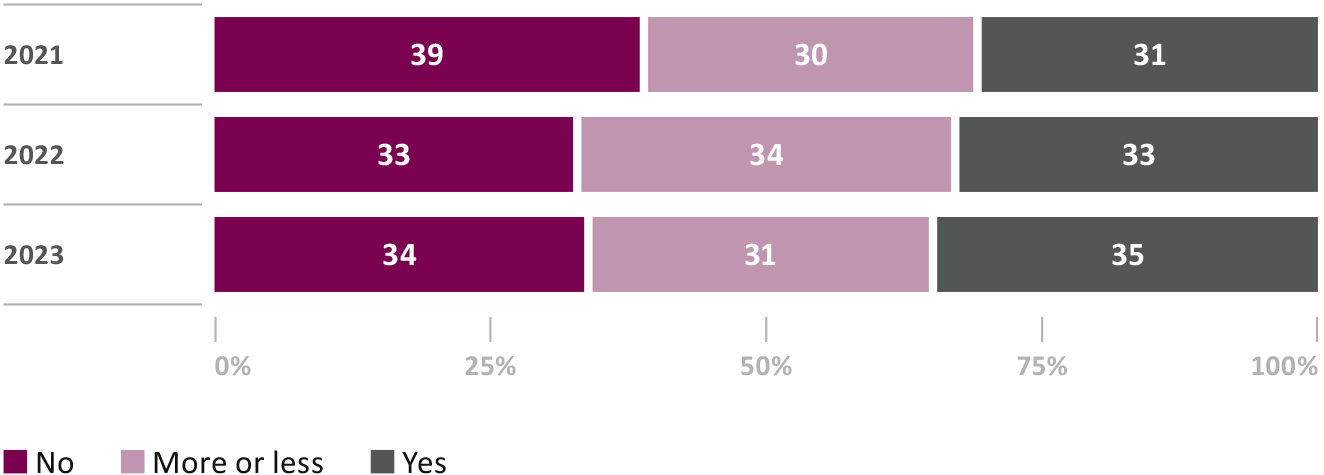

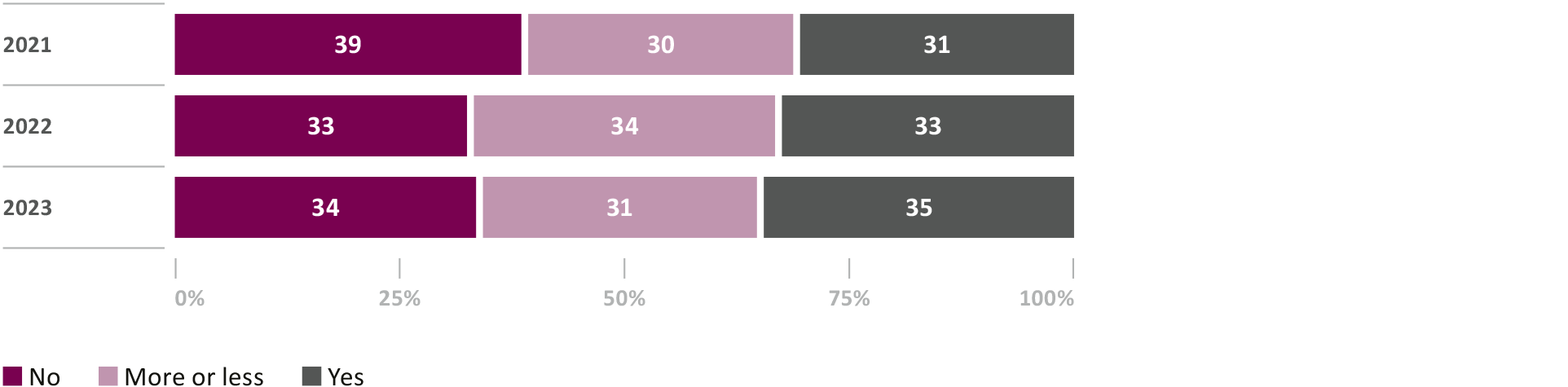

Only a third were aware of redistribution

This is why there is no outcry, despite the fact that a considerable portion of retirement income is currently being redistributed from the employed to pensioners due to an excessively high conversion rate. If you account for all respondents, skepticism of this unconventional redistribution has decreased in comparison to previous years: despite ongoing debate about pension reform, only a third indicate that they are well informed about the redistribution. Of the respondents who were informed about this issue, about half of them previously assessed this redistribution as unfair. For the current survey, this figure was only 43 percent. At first then, only a minority has a fundamental problem with the redistribution of pension income from the employed to pensioners. A principle of the 2nd pillar is being contravened here, however, namely that each individual saves for their own pension. "This is in keeping with a general trend: whether state Covid-related subsidies or interventions in the financial center – the state is increasingly being seen as an institution that can provide financial security for everything," comments Michael Hermann.

Knowledge of redistribution within 2nd pillar

Majority of working population finds redistribution unfair

Financial knowledge key to understanding BVG

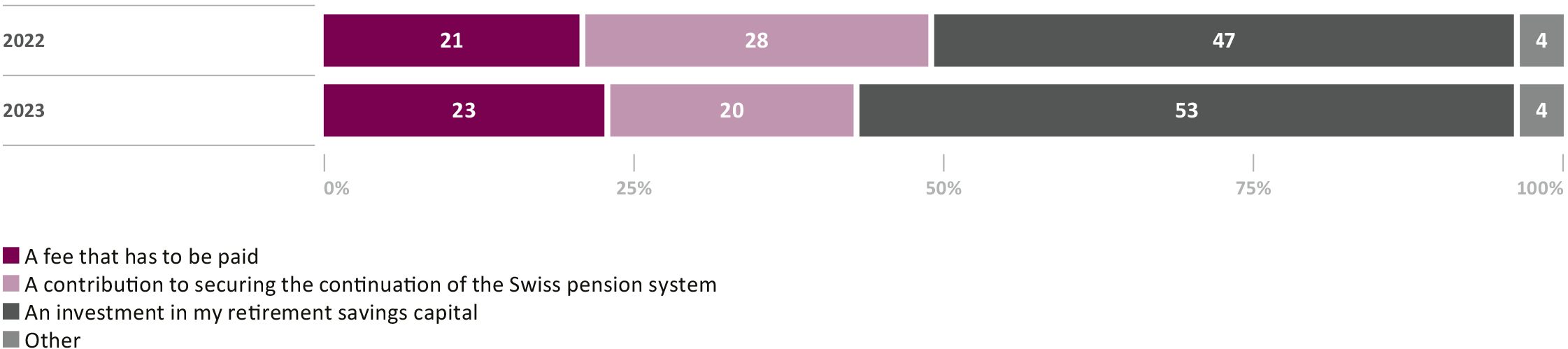

The current study also shows how important knowledge of investment opportunities and, in particular, personal experience with the topic of investing are. This knowledge is a prerequisite for understanding the function of the 2nd pillar and the ability to estimate the consequences of current inflation on retirement provision: an overwhelming majority of 87 percent would welcome it if knowledge of retirement provision and investments were part of the school curriculum. Currently, personal experience is proving to be a particularly useful source of advanced financial knowledge. Awareness of the fact that salary deductions for occupational retirement provision constitute an investment in personal retirement savings capital is growing: only 47 percent of respondents were aware of this in the 2022 survey. In this year's survey, this value has increased to 53 percent. The remainder of respondents view the contributions into the 2nd pillar as a type of tax or fee. Although awareness of this topic has improved, this has yet to translate into a meaningful impact on behavior: only a fifth of those surveyed stated that the structure of the pension fund was an important factor for them when starting a new job.

Perception of salary deductions for BVG

Inflation – the effect on occupational retirement provision is underestimated

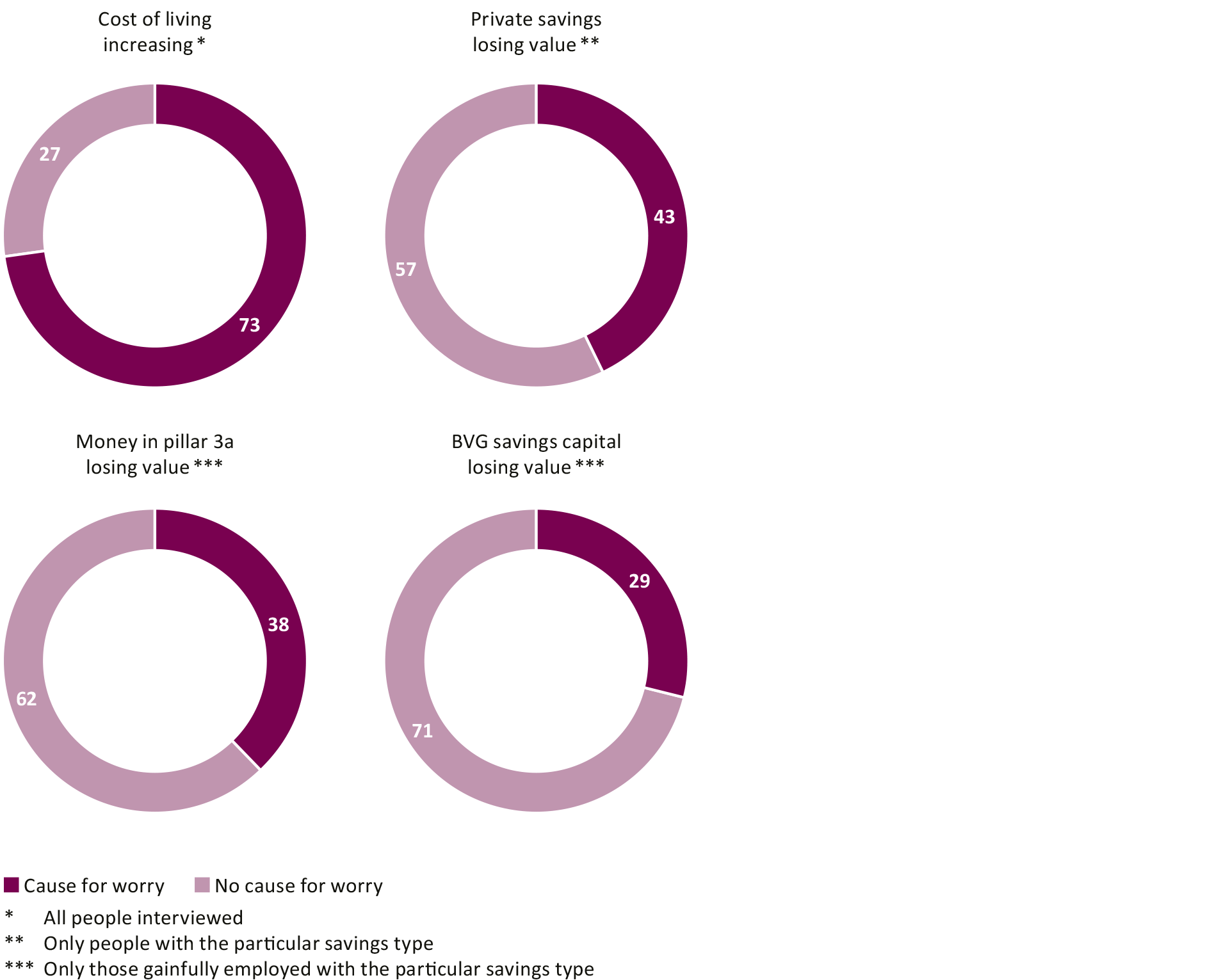

At 2.8 percent, average annual inflation in Switzerland in 2022 reached its highest point for nearly 30 years. In addition to impacting shopping, inflation also reduces the value of financial assets, e.g. savings accounts. There is little awareness of this among the population: they are considerably more concerned about the rising cost of living (73 percent) than the devaluation of their savings (43%). A meager 29 percent of the active ensured are concerned about the loss of purchasing power of their BVG capital. A contributing factor here is that the majority of those surveyed do not consider the BVG balance as part of their assets, so the connection to this important component of personal wealth is weak. This is particularly noticeable among women: women are more frequently concerned about the loss of purchasing power than men, but are less frequently concerned about the loss of the purchasing power of their BVG savings. What's more, according to the survey, they responded less frequently to inflation and reallocated their savings to investment vehicles less often.

Reasons for concern due to inflation

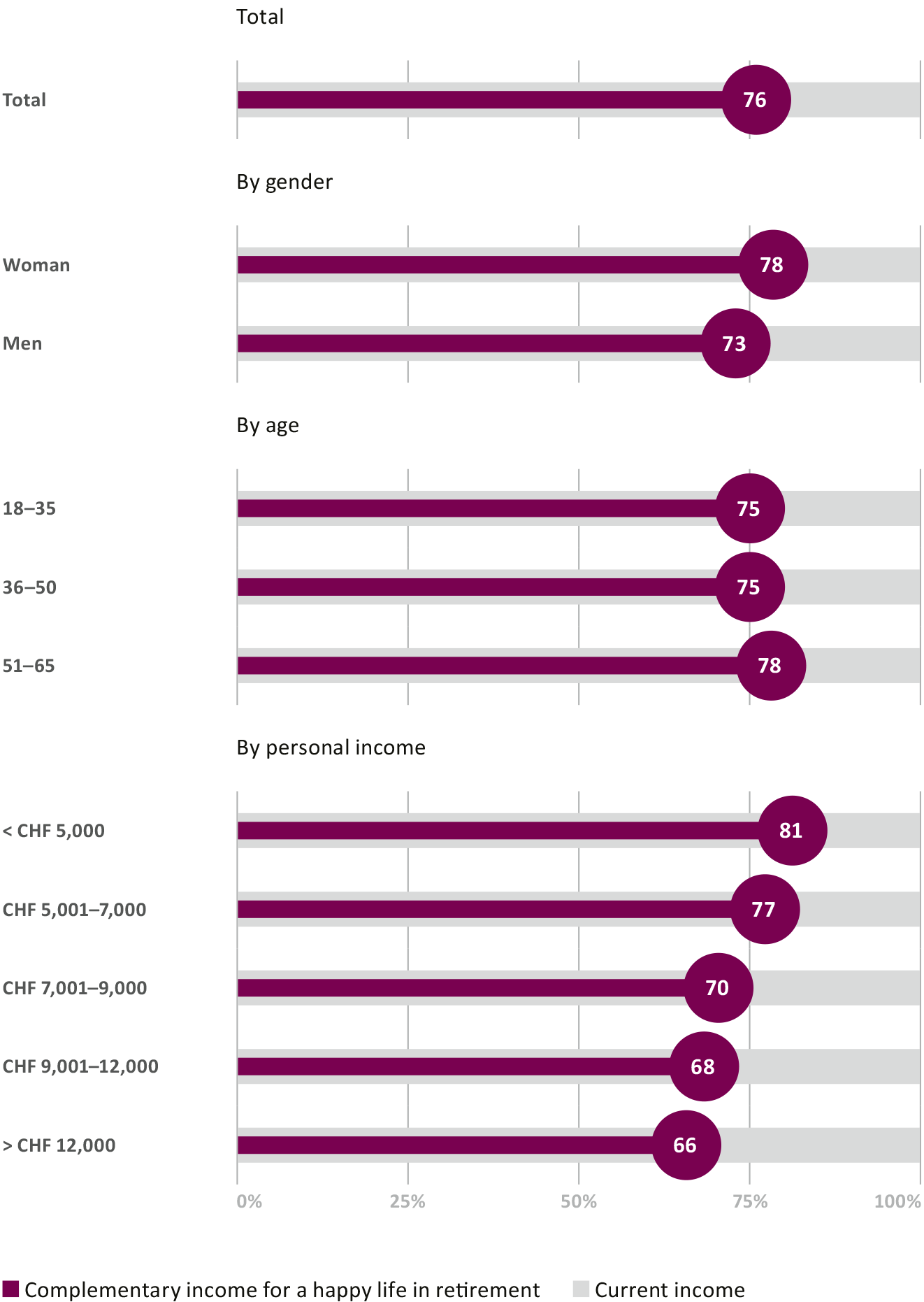

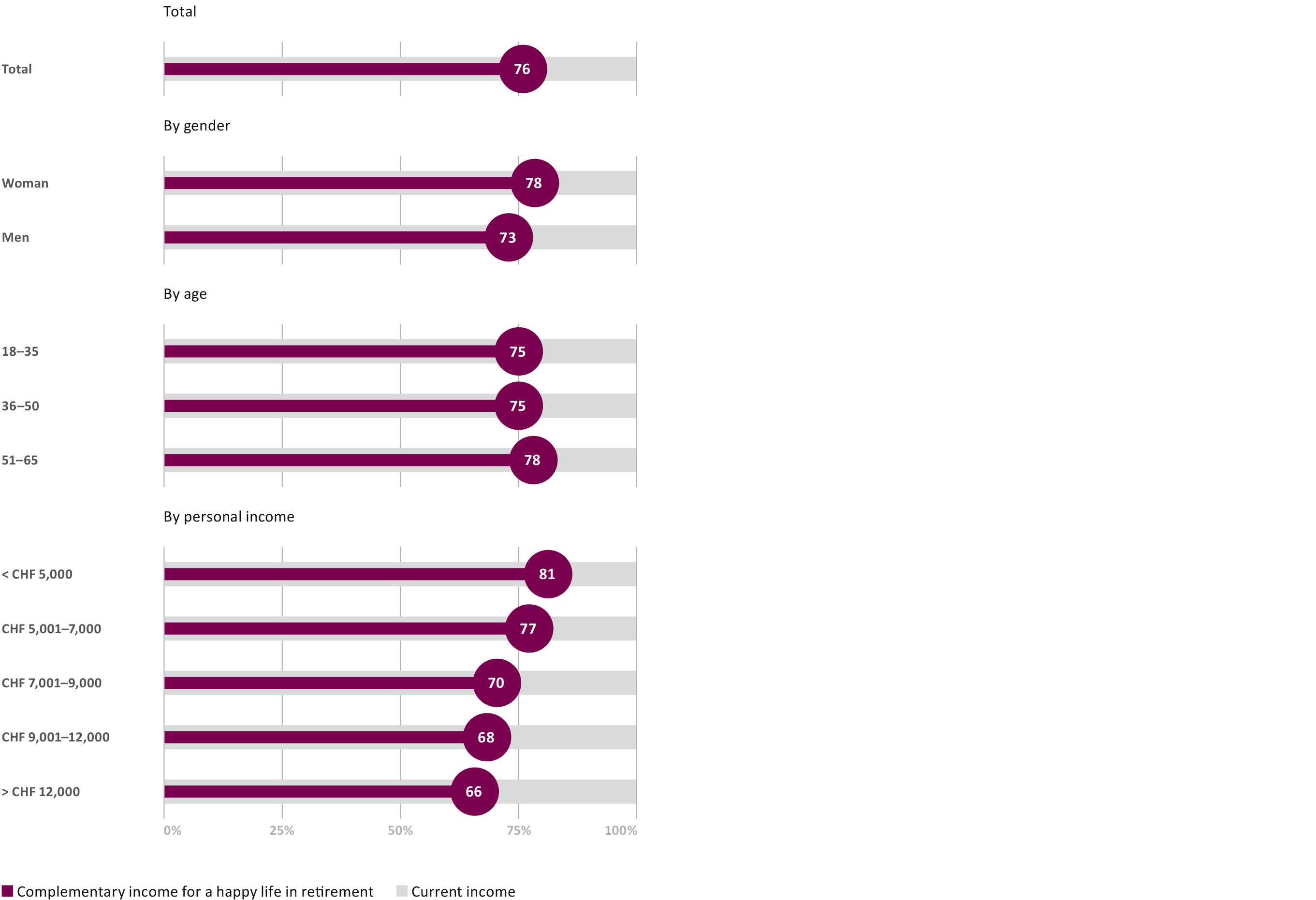

The gap between dream and reality

According to the survey, the Swiss population will, on average, need 76 percent of their current income after retirement to be "completely satisfied." However, the state and occupational retirement provision, pillars 1 and 2, are not sufficient to enable this: according to the goal defined by the Confederation, these two pillars together should generate around 60% of a person's final gross income after retirement. Depending on the individual situation, this value can sink lower, as low as 50 percent, for example. Factors such as the period of low interest rates over previous years, inflation, and redistribution can result in a scenario whereby the longer a person saves, the less likely they are to reach the 60 percent target with pillars 1 and 2. For many, there is an increasing gap between dream and reality. This can only be closed if people consistently make voluntary provision for their retirement by paying into the 3rd pillar. Consequently, it is enormously important to raise awareness for these connections within retirement provision – to ensure that people can set the right financial course for their future.