These results are particularly interesting for employers:

Lack of retirement provision – you regret it later

If you ask retirees which retirement decisions they regret, almost half of them say: "Nothing." Nevertheless, there are an astonishing number of people who, looking back, would do things differently: 30 percent regret that they paid too little or too late into pillar 3a. And some also cite shortcomings in occupational retirement provision: 12 percent regret that they paid too little voluntarily into the 2nd pillar, and 9 percent paid too little attention to the benefits of their pension fund. This is remarkable because many people are not very familiar with pillar 2 benefits.

What does this mean for you as an employer?

As an employer, it is important that you show your employees what pension options the 2nd pillar offers them. Many people are not even aware of the purchasing options, for example. You should also make your employees aware of the importance of the 3rd pillar.

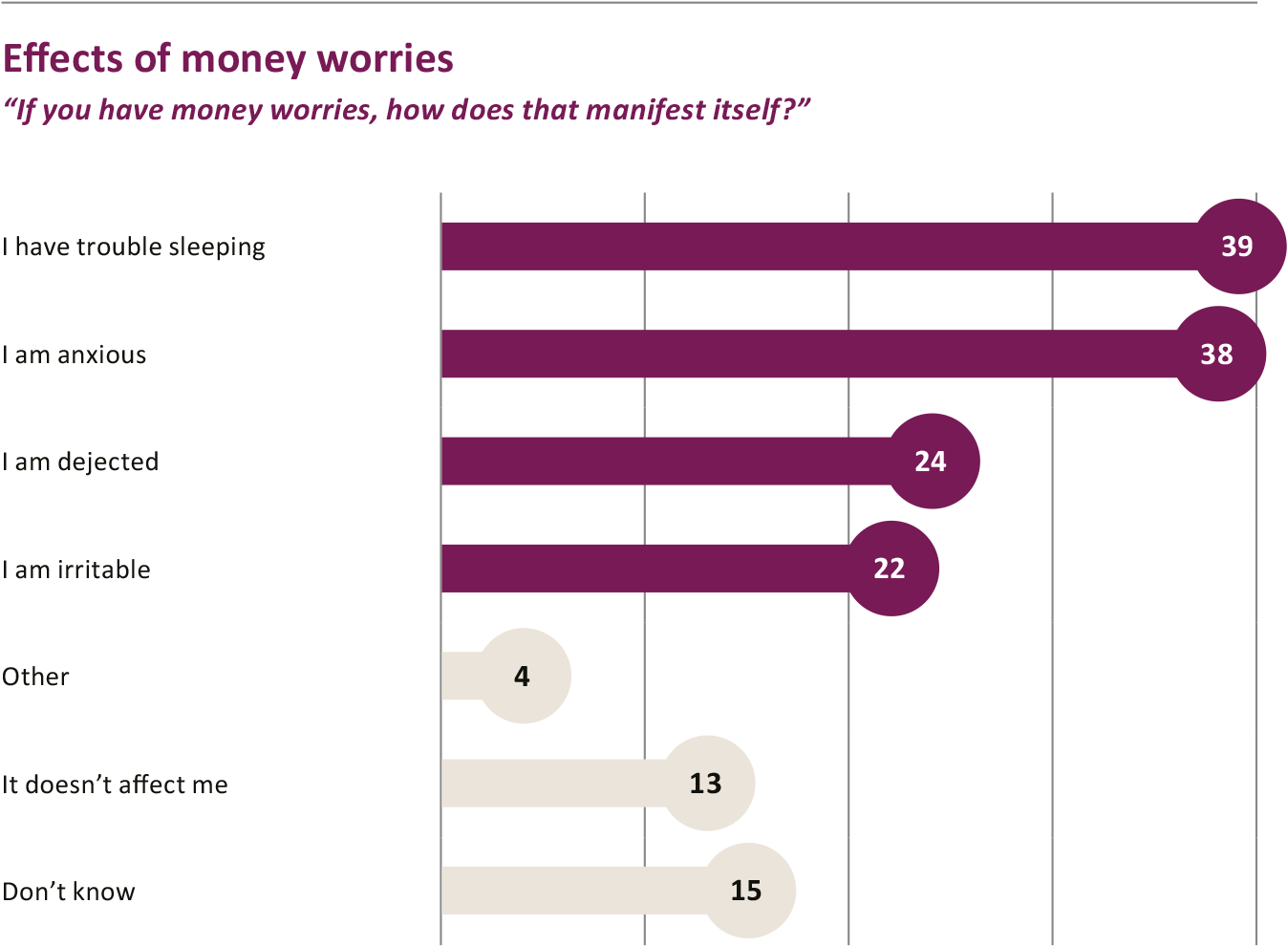

Sustainable investment by pension funds is important

A clear majority of respondents (64 percent) consider it important that their pension fund invests sustainably, i.e. takes environmental and/or social aspects into account. This applies to all age groups. The majority of private investors (57 percent) are also willing to sacrifice returns for greater sustainability.

What does this mean for you as an employer?

You can assume that your employees are also interested in the investment strategy of your chosen pension fund. You should be prepared to answer relevant questions – or even better, actively provide information on this important topic.

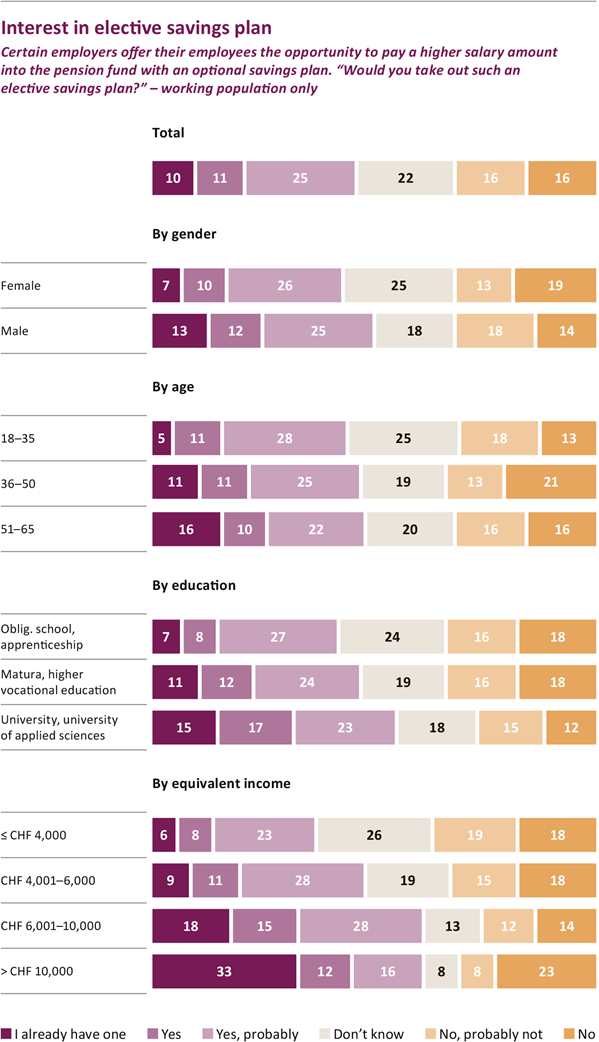

Elective savings plans are interesting – even for low incomes

An optional savings plan allows employees to pay more into their pension fund and thus actively shape their occupational retirement provision. According to the survey, 10 percent of the working population already use this option. A further 36 percent would be open to such an option. Only just under a third reject this option for themselves. Interest is particularly high among people with a high income, but a third of people with a low income are also interested.

What does this mean for you as an employer?

Even people with little financial leeway often wish to make greater provision for old age via the 2nd pillar. Some people have not yet formed an opinion on the subject of "elective savings plans," especially the less qualified, the young, those on low incomes and women. It is precisely these groups that also have below-average financial knowledge. For you as an employer, this is an opportunity to raise your employees' awareness of the benefits and options offered by their pension fund – and, if necessary, to offer them an optional savings plan.

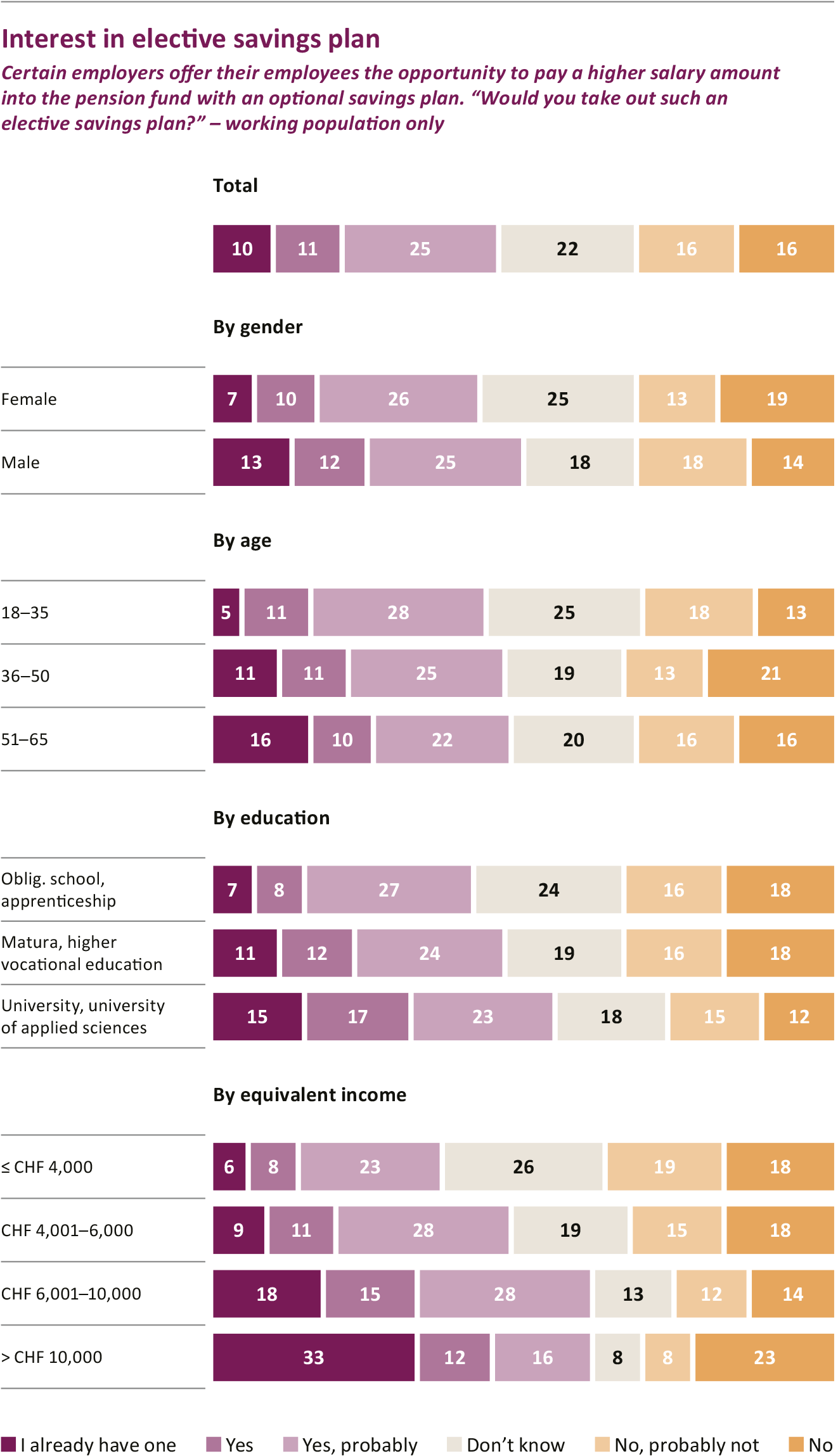

Money does make you happy

34 percent of respondents in the "Fairplay" study have had money worries in the last year, women more often than men (39 instead of 29 percent) and young people significantly more often than older people (50 instead of 11 percent). These concerns are not without consequences: 39 percent of those affected sleep worse, 38 percent feel anxious and a quarter struggle with depression or irritability.

What does this mean for you as an employer?

A third of your employees – possibly even half in a young team – have had money worries in the last year. These can put a strain on personal well-being. This makes it all the more important that you provide information on financial topics. In this way, you not only help your employees to shape their financial future, but also support them in the here and now. You can also successfully position yourself as a committed employer.

Inform your employees about retirement provision – we will support you!

As part of a staff orientation session, such as "Vita Mobil", your employees receive information about the basics of social security and the benefits of your chosen pension fund solution. Our experts show how the three pillars of the Swiss pension system interact and what options employees have to optimize their individual retirement provision. This service is free of charge and can also be carried out online on request.