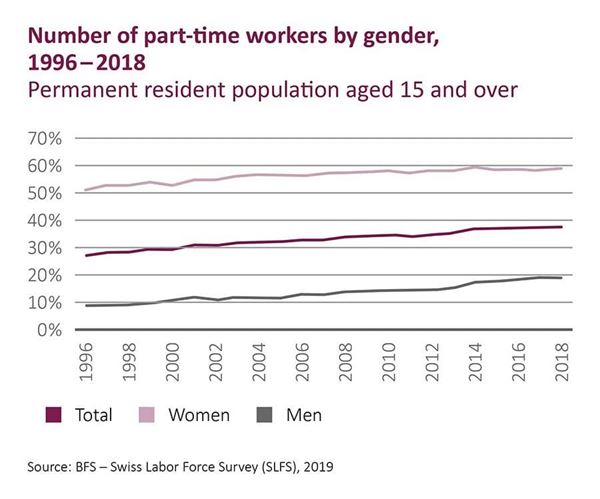

Three in five women work part time

Currently, three in five women and even one in five men work part time. It is mainly mothers who reduce their hours, sometimes significantly, but fathers are also increasingly working part time. Continuing education or a second source of income from self-employment could be the reason for working part time. Some simply say: "My life should not just consist of work," and by reducing their hours they gain more free time. Employees in the last years before retirement are especially interested in this option.

Occupational retirement provision: focused on full-time work

But what many part-time employees are not aware of is that they are at risk of serious shortfalls in occupational retirement provision. This has its roots in the 70s and 80s when working full time was considered the "norm". This is why the system is aligned with a coordinated retirement provision with continuous payments in the first and second pillars. Companies can better insure part-time employees if the coordination deduction is adapted to the level of work and at best if the entry threshold is also lowered. Many companies are already taking advantage of this possibility. Nevertheless, these lead to higher contributions for the insured and employers.

Part-time employees should take note of these five tips so that they aren’t left high and dry upon retiring:

- Check your insured salary

Usually, the so-called coordination deduction, currently at 24,885 Swiss francs, is deducted from the annual salary to calculate the insured salary. If you have an annual income of 35,000 Swiss francs working 60 percent of full time hours, you will, in this instance, be insured for 10,115 Swiss francs with the pension fund. This insured salary has an effect on the level of pension fund contributions.

Employees can consider themselves lucky if their pension fund reduces the coordination deduction for part-time employees, for example, in relation to the working hours. In this case, only CHF 14,931 Swiss francs would be deducted instead of 24,885. This results in a higher insured salary of 20,069 which, likewise, results in higher pension fund contributions. The retirement assets also rise "faster" accordingly. If you are applying for a part-time job you should definitely cast a critical eye over the pension fund rules of your potential employer. - Seek advice to close shortfalls early on

A retirement provision specialist can precisely explain your pension certificate and show you how your annual salary is insured in the occupational retirement provision if you work fewer hours. Based on the information in the pension certificate, he or she can show you what benefits you can expect from your pension fund after retirement or in case of disability from illness. Did these analyses result in pension shortfalls? Your pension advisor can give you recommendations on how to reduce these shortfalls or completely eliminate them, whether this is in the second or even in the third pillar. - Ask your employer

Modern pension funds offer their insured persons additional options to tailor the occupational retirement provision to their personal situation, such as with an extended savings plan. A tax-efficient purchase into the pension fund can also be of interest for part-time workers as this reduces income tax and saves money. Many pension funds offer older employees the option to continue making full contributions even when their working hours are reduced. Check with your employer which options are available. Don't forget: private retirement provision in the third pillar is also an important and flexible instrument for closing pension shortfalls. - Take advantage of private retirement provision

According to a recent study by Credit Suisse, only half of all employees even pay into the third pillar at all – and of those, only a third pay the full contribution of 6,826 Swiss francs. Taking an average of all people in employment, 2,870 Swiss francs are paid in. But for part-time employees in particular, it is important to pay at least a certain contribution into the third pillar. This allows pension shortfalls to be balanced out on retirement and a proportionately large amount of money to be saved, provided that contributions are paid into the second pillar and the maximum amount is paid into pillar 3a. Pillar 3a also offers the opportunity of combining retirement savings with risk protection. If you choose a 3a account, you can pay in flexibly and leave it until December to decide how much money you are able to put aside for private retirement provision. In addition to the classic bank savings which only offer low interest rates these days, there are additional options: for example, a 3a account with custody account and investment in corresponding active and passive or index-based security funds. - Don't forget pillar 3b

Have you already fully utilized pillar 3a or are you looking for greater flexibility, for example in the type of investment? Then the unrestricted pension plan (pillar 3b) may be an interesting option for you. This is life insurance with risk protection. For example, you can insure your family or loved ones while your capital generates a return. As with pillar 3a, you pay in annually, or you make a one-off higher contribution.